11 Family Offices in New York Active in Venture

A curated list of family offices in New York that back venture funds, co-invest in deals, and show up in the private markets.

A curated list of family offices in New York that back venture funds, co-invest in deals, and show up in the private markets.

Slow Ventures partner Sam Lessin shares how emerging VC managers can think clearly about fund strategy, size, LP composition, and capital efficiency when building a durable seed fund.

A clear breakdown of VC compensation, showing how fund size, fees, and carry shape incentives, behavior, and decision-making inside venture firms.

Mark Phillips, founder of 11 Tribes Ventures, shares how he raised two VC funds through resilience & relationship-driven LP outreach — offering a candid playbook for emerging managers.

Here’s a plain-English breakdown of how limited partnerships, LLCs, LPAs, and management companies fit together — and why almost everyone ends up in Delaware.

Cold outreach from VCs to LPs rarely works — unless it’s relevant. Here’s how to craft messages that stand out, add value, and get real replies (plus one tool that turns “cold” into “warm”).

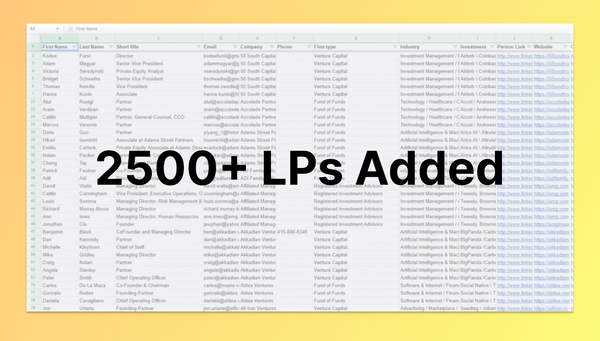

TL;DR: We’ve expanded the Fundingstack database with 2,500 Limited Partners (LPs), many of whom actively invest in venture funds and emerging managers.

Courtney McCrea of Recast Capital shares five essential lessons for emerging VC managers.

Renata Quintini, co-founder of Renegade Partners, shares her Fund I playbook—winning LPs, creating FOMO, and scaling to Fund II.

Discover the best tools for investment bankers in 2025—CRMs, data rooms, investor databases, and AI platforms to streamline deal-making.

Learn how VCs build lasting LP trust through transparency, communication, and discipline—driving loyalty and faster fundraising.

Explore the top 5 CRMs for investor relations and learn how to streamline fundraising, boost LP trust, and manage capital with ease.